Published: 18 Feb 2026, 04:15 am

In a landmark appointment for Bangladesh’s restructured financial sector, Nabil Mustafizur Rahman has been designated as the Managing Director (MD) of the newly formed state-owned Sommilito Islami Bank PLC. Previously serving as the Additional Managing Director (AMD) of United Commercial Bank (UCB), Mr Rahman brings over three decades of high-level banking expertise to this critical role.

The Financial Institutions Division of the Ministry of Finance formalised the move last Sunday, issuing a letter to the Chairman of the bank’s Board of Directors. The communication conveyed the government’s official consent for Mr Rahman’s appointment on a three-year contractual basis, effective from his date of joining.

The appointment is being processed in strict accordance with the Bank Company Act, 1991. Speaking to the press on Tuesday, the Chairman of Sommilito Islami Bank, Mohammad Ayub Mia, confirmed that the board would review the proposal within days. Following a ‘No Objection Certificate’ (NOC) from the central bank, the appointment is expected to be finalised within a week.

Nabil Mustafizur Rahman is an alumnus of the prestigious Institute of Business Administration (IBA) at the University of Dhaka. His 31-year career spans several major financial institutions, where he has held pivotal leadership roles:

United Commercial Bank (UCB): Oversaw Risk Management, Islamic Banking, and Transaction Banking.

BRAC Bank: Served as Deputy Managing Director (DMD).

Habib Bank Limited: Acted as the Country Chief Risk Officer for Bangladesh operations.

| Feature | Details |

|---|---|

| Name | Nabil Mustafizur Rahman |

| Education | IBA, University of Dhaka |

| Total Experience | 31 Years |

| Tenure | 3 Years (Contractual) |

| Specialisations | Risk Management, Islamic Finance, Operations |

Sommilito Islami Bank PLC is a strategic consolidation of five previously separate entities: EXIM, Social Islami, First Security Islami, Global Islami, and Union Bank. This merger aims to stabilise the Islamic banking sector and restore depositor confidence through robust state backing.

The financial scale of the new entity is unprecedented in the local market. It boasts an authorised capital of 40,000 crore BDT and a paid-up capital of 35,000 crore BDT. Of the paid-up amount, the Government of Bangladesh has injected 20,000 crore BDT, while the remaining 15,000 crore BDT is sourced from depositor shares. With Mr Rahman at the helm, the bank is poised to navigate the complexities of this massive integration.

In a notable shift within the upper echelons of the interim administration, Dr Khalilur Rahman has f...

As the Islamic world prepares for the holiest month of the year, the Islamic Foundation has announce...

In a political journey spanning over two decades, Ariful Haque Chowdhury has transitioned from a gra...

The contemporary music scene is witnessing a vibrant expansion as the versatile singer-songwriter Me...

Following a landslide victory in the 13th General Election, Tarique Rahman, Chairman of the Banglade...

In a decisive move to bolster the administrative framework of the new government, the 11th Prime Min...

In a remarkable display of operational efficiency and commitment to policyholder welfare, Zenith Isl...

In a significant move signalling a new chapter in regional diplomacy, Indian Prime Minister Narendra...

In the newly formed government led by Tarique Rahman, a striking pattern has emerged: twenty-five di...

In a tragic incident that has left the community of Chandina in shock, a fierce overnight blaze engu...

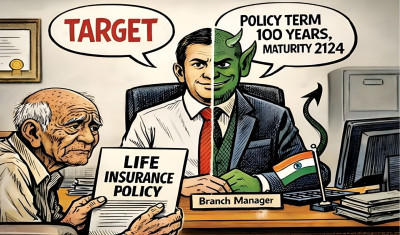

A startling case of alleged insurance mis-selling has emerged from Nagpur in the Indian state of Mah...

After several months of hiatus, Dhaka is set to witness a grand open-air music event once again. Due...