Published: 17 Feb 2026, 05:29 am

The Office of Insurance Commission (OIC) of Thailand has announced a landmark modernisation of its digital infrastructure, achieving a staggering 90% reduction in database backup durations. By migrating from restrictive legacy systems to a high-performance data platform powered by NetApp, the regulator has effectively transformed processes that previously took hours into streamlined operations completed in mere minutes.

As the primary overseer of Thailand’s insurance sector, the OIC faced mounting pressure to evolve alongside a rapidly digitising market. The previous infrastructure was plagued by scalability constraints and sluggish processing speeds, which hindered the commission's ability to perform real-time market surveillance.

The implementation of NetApp’s ONTAP Snapshot technology has served as the catalyst for this transformation. By decoupling data protection from core workloads, the OIC can now execute backups without compromising the performance of its primary regulatory applications. This ensures that the flow of critical information—such as claims data and industry risk trends—remains uninterrupted.

The following table illustrates the operational improvements observed following the infrastructure overhaul:

| Metric | Legacy Infrastructure | Modernised NetApp Platform |

|---|---|---|

| Backup Duration | Several Hours | Minutes (90% reduction) |

| Recovery Time Objective | High Risk / Delayed | Rapid / Automated Recovery |

| Scalability | Rigid / Limited | Dynamic / High Growth Support |

| System Impact | Core Workloads Slowed | Negligible Performance Hit |

| Supervision Style | Reactive / Manual | Proactive / AI-Enabled |

Beyond mere speed, the upgrade is a foundational step toward the OIC’s goal of becoming a data-driven regulator. The new architecture introduces robust cyber resilience, featuring automated disaster recovery protocols that safeguard against data loss and ransomware threats.

The refined infrastructure is specifically designed to support advanced analytics and AI-enabled supervision. By harnessing these tools, the OIC aims to enhance its capabilities in:

Fraud Detection: Identifying suspicious patterns in claims data with greater precision.

Risk Assessment: Evaluating the solvency and stability of insurance providers in real-time.

Market Surveillance: Monitoring industry-wide shifts to inform timely policy interventions.

The OIC’s successful deployment of enterprise-grade storage solutions demonstrates a commitment to governance and operational excellence. By eliminating the technical debt of legacy storage, the commission is now positioned to lead the Thai insurance industry into an era of digital transparency and heightened security.

In a remarkable display of operational efficiency and commitment to policyholder welfare, Zenith Isl...

In a renewed gesture of inclusivity, the English Premier League and the English Football League have...

Jennifer Jimenez, band director at South Miami Senior High School, has been named the recipient of t...

Fortune did not favour Australia in the 2026 ICC T20 World Cup as their faint hopes of progressing t...

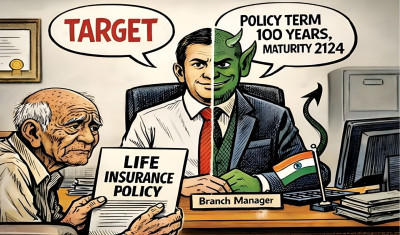

A startling case of alleged insurance mis-selling has emerged from Nagpur in the Indian state of Mah...

BERLIN, 17 February 2026 – Germany and France are jointly urging the European Commission to introduc...

With the 2026 FIFA World Cup just days away, excitement is mounting for potential new records on foo...

Joachim Nagel, President of the Bundesbank, has signalled a decisive shift in Europe’s stance on dig...

Barcelona’s hopes of reclaiming the top spot in La Liga were dashed after a dramatic 2-1 defeat agai...

The former spouse of Pakistani all-rounder Imad Wasim has broken her silence following his announcem...

Names can sometimes shape destiny, or so it seems in cricketing lore. On a sunlit day at Chennai’s M...

New Zealand produced a commanding performance to thrash Canada in the ICC T20 World Cup Super Eight...