Khaborwala Online Desk

Published: 17 Feb 2026, 06:20 pm

BERLIN, 17 February 2026 – Germany and France are jointly urging the European Commission to introduce a comprehensive “financial services simplification package”, aimed at making European Union regulations more accessible and less burdensome for businesses, according to a letter obtained by Reuters on Tuesday.

The correspondence, addressed to European Commissioner for Financial Services Maria Luís Albuquerque and dated last Friday, was co-signed by German Finance Minister Lars Klingbeil and French Finance Minister Roland Lescure. It outlines a series of areas where EU financial legislation could be streamlined without compromising market stability or regulatory oversight.

The ministers emphasised that minor adjustments to future legislation alone would be insufficient. Instead, they advocate for a comprehensive review and simplification of existing rules, with the dual goal of strengthening the EU single market for financial services and enhancing the global competitiveness of European financial institutions.

Key proposals highlighted in the letter include:

| Area of Reform | Proposed Change | Expected Benefit |

|---|---|---|

| Transaction Reporting | Report financial market transactions once only, relying on established market practices | Reduces duplication and administrative burden for firms |

| Delegated Powers | Repeal unused or redundant delegated powers | Streamlines regulatory framework |

| Cyber Reporting | Simplify reporting requirements for cybersecurity | Decreases compliance costs while maintaining security standards |

| Banking Regulation | Further input to be provided to the Commission | Ensures coherent and competitive EU banking rules |

The ministers argued that these reforms would allow financial firms to operate more efficiently, while still upholding financial stability, investor protection, and regulatory oversight. They further indicated that Germany and France are preparing detailed proposals on banking regulations, which will be submitted to the Commission in the near future.

Financial analysts have suggested that such a package could have a significant impact on the European banking sector, particularly in reducing compliance costs for mid-sized and large institutions, while also clarifying overlapping rules that have emerged over the past decade.

The move reflects a broader push by major EU member states to enhance the attractiveness of Europe as a global financial hub, particularly as the bloc competes with London, New York, and Asian financial centres. By simplifying both existing and upcoming rules, France and Germany aim to foster a more predictable and transparent regulatory environment for investors and institutions alike.

In a landmark appointment for Bangladesh’s restructured financial sector, Nabil Mustafizur Rahman ha...

In a remarkable display of operational efficiency and commitment to policyholder welfare, Zenith Isl...

In a renewed gesture of inclusivity, the English Premier League and the English Football League have...

Jennifer Jimenez, band director at South Miami Senior High School, has been named the recipient of t...

Fortune did not favour Australia in the 2026 ICC T20 World Cup as their faint hopes of progressing t...

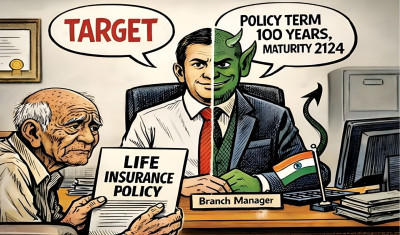

A startling case of alleged insurance mis-selling has emerged from Nagpur in the Indian state of Mah...

Staff Reporter:In a significant development for the nation’s media landscape, renowned journalist, w...

Today marks the 18th death anniversary of the beloved Bangladeshi film actor Manna, a luminary of Dh...

With the 2026 FIFA World Cup just days away, excitement is mounting for potential new records on foo...

Joachim Nagel, President of the Bundesbank, has signalled a decisive shift in Europe’s stance on dig...

Brahmanbaria-2’s independently elected Member of Parliament (MP), Rumin Farhana, has raised concerns...

After a hiatus of nearly three years following the release of Hyena Express in 2020, the acclaimed i...