Published: 13 Jan 2026, 03:03 am

As India prepares for the unveiling of the Union Budget 2026 in February, policy circles and industry stakeholders are abuzz with anticipation regarding a sweeping "insurance push". At the heart of these discussions is the ambitious "Insurance for All by 2047" goal set by the Insurance Regulatory and Development Authority of India (IRDAI). To bridge the protection gap, the government is expected to pivot towards a grassroots-led strategy, primarily focusing on rural women and climate-resilient agriculture.

A cornerstone of the upcoming budgetary proposals is the potential introduction of a specialised insurance product tailored for rural women. The strategic brilliance of this plan lies in its integration with the Pradhan Mantri Jan Dhan Yojana (PMJDY). By using Jan Dhan accounts as a primary delivery platform, the government can bypass traditional barriers such as complex paperwork, physical bank visits, and lack of awareness.

With over 550 million accounts opened under PMJDY—a vast majority of which are held by women—the infrastructure for immediate, scalable insurance distribution is already in place. Integrating insurance with these accounts would ensure that financial shocks—such as health emergencies or the loss of a breadwinner—do not spiral into a cycle of debt, thereby protecting the family’s spending on education and nutrition.

The 2026 Budget is also expected to address the escalating volatility of climate change. With floods, heatwaves, and cyclones becoming more frequent, the existing crop insurance framework requires an overhaul. Discussions suggest an increase in budgetary allocations for climate-risk insurance, broadening the definition of "risk" to include subtle weather shifts that impact yield.

Experts argue that if disaster-based compensation becomes swifter and more digitised, it will stabilise the rural economy during lean periods. By ensuring liquidity reaches farmers immediately after a climate event, the government can prevent large-scale migration and agricultural distress.

| Target Segment | Proposed Mechanism | Expected Impact |

|---|---|---|

| Rural Women | PMJDY-linked Micro-insurance | Seamless enrolment and automatic premium debits. |

| Farmers | Enhanced Climate-Risk Coverage | Faster payouts for extreme weather events. |

| Low-income Groups | GST Rationalisation on Premiums | Lowering the cost of entry for life and health cover. |

| Digital Infrastructure | Bima Sugam Platform Integration | End-to-end digital sales and claim settlements. |

While the policy intent is clear, the success of these initiatives hinges on affordability and accessibility. To make insurance truly "universal", the Budget must address the high cost of premiums for low-income households. There is a strong call from the industry to reduce the GST on insurance premiums (currently at 18%) to make products more attractive to the masses.

Furthermore, the "Bima Sugam" digital marketplace is expected to play a vital role. By centralising data, the government aims to make claim settlements as simple as a banking transaction. If the 2026 Budget succeeds in weaving rural women and farmers into a cohesive safety net via the Jan Dhan platform, it will mark a definitive step towards an insured and resilient India by 2047.

Allysa Healy, widely regarded as one of the most successful cricketers in women’s cricket history, h...

On Monday, 12 January, Bangladesh Bank acquired USD 81 million from ten commercial banks through a s...

Mounting pressure, dressing-room unrest, and a widening gap between the squad and management culmina...

Iran is reportedly preparing to carry out its first death sentence in connection with the ongoing an...

Southern California-born singer-songwriter Claire Rosinkranz has released her latest single, Chronic...

In a stunning upset that has left French football fans reeling, Paris Saint-Germain (PSG) were elimi...

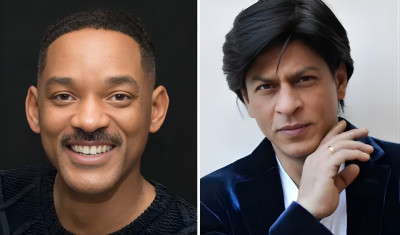

Oscar-winning American actor and rapper Will Smith has publicly expressed his keen interest in worki...

Global insurance giant Allianz SE has announced a strategic partnership with artificial intelligence...

Iran is fully prepared for military confrontation should the United States seek to test its capabili...

Osman Ershad Foyez has officially assumed the role of Managing Director (MD) of Dhaka Bank PLC, comm...

The number of fatalities in Iran’s ongoing anti-government protests has surged to at least 648, acco...

In a significant escalation of Middle Eastern tensions, President Donald Trump is scheduled to conve...