Published: 13 Jan 2026, 05:33 am

In a landmark shift for the nation’s financial architecture, the interim government has finalised the framework for establishing specialized Microfinance Banks. Deviating from earlier proposals to create a separate wing under the Microcredit Regulatory Authority (MRA), the responsibility for licensing and supervising these new entities has been formally entrusted to Bangladesh Bank.

The move follows the vision of Chief Advisor and Nobel Laureate Professor Muhammad Yunus, who has long advocated for "social business" models in banking. Speaking at the inauguration of the MRA's new headquarters last year, Professor Yunus asserted that microfinance represents the future of banking—built not on collateral, but on trust and social impact.

The "Microfinance Bank Ordinance 2025" outlines a more robust capital base than originally suggested. While initial drafts proposed a paid-up capital of 100 crore BDT, the final draft has doubled this requirement to ensure financial stability.

A unique feature of these banks is their ownership model, designed to empower the borrowers themselves. Unlike conventional commercial banks, these institutions will operate as social businesses and will be barred from listing on the stock market to prevent speculative profit-seeking.

| Financial Metric | Initial Proposal (BDT) | Finalised Draft (BDT) |

|---|---|---|

| Authorised Capital | 300 Crore | 500 Crore |

| Paid-up Capital | 100 Crore | 200 Crore |

| Borrower-Shareholder Stake | — | 60% |

| Entrepreneur/Sponsor Stake | — | 40% |

The ordinance stipulates that these banks will be governed by a 10-member Board of Directors. This board will include:

Four Directors elected by borrower-shareholders.

Three Directors nominated by non-borrowing shareholders.

Two Independent Directors appointed by Bangladesh Bank.

One Managing Director (ex-officio, without voting rights).

While the banks must register under the Companies Act 1994, they will be strictly regulated under the Bank Company Act, ensuring they adhere to the same rigorous standards as commercial lenders.

The microfinance sector in Bangladesh is vast, currently dominated by 683 NGOs serving over 3.23 crore members—91% of whom are women. As of June 2024, these institutions held a staggering 2.64 lakh crore BDT in total loans.

Despite the government's optimism, major players like BRAC, ASA, and TMSS have expressed reservations. In a joint statement issued on 4 January 2026, seventeen leading microfinance institutions warned that the proposed ordinance might create fresh crises rather than solving existing ones. Specifically, the Credit and Development Forum (CDF) argued that the 200 crore BDT capital requirement is too high, suggesting that a 50 crore or 100 crore BDT threshold would have allowed more grassroots organisations to transition into banks.

Financial Institutions Division Secretary Nazma Mobarek confirmed that the draft has been sent to the Cabinet Department for final approval. Once approved by the Advisory Council, the ordinance will be officially promulgated. Former Bangladesh Bank Chief Economist Mustafa K. Mujeri noted that while central bank oversight is positive, the government should initially issue a limited number of licences to monitor performance before a wider rollout.

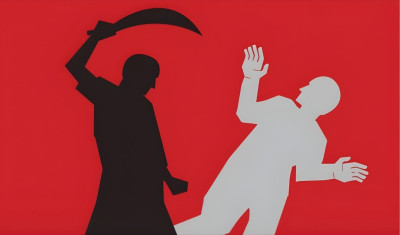

In a shocking incident in Fatulla, Narayanganj Sadar Upazila, 45-year-old chef Raihan Molla was fata...

Global insurance giant Allianz SE has announced a strategic partnership with artificial intelligence...

Tensions between Bangladesh and India’s cricket boards have intensified following the exclusion of B...

Despite ongoing sporting tensions with India, the Bangladesh Football Federation (BFF) has expressed...

A nine-year-old girl, Huzaifa Afnan, from Ward 3 of Hoyaikyaing Union in Teknaf, has been critically...

Osman Ershad Foyez has officially assumed the role of Managing Director (MD) of Dhaka Bank PLC, comm...

The sporting world remains in a state of high tension as the deadlock between the Bangladesh Cricket...

In a significant move to bolster the nation’s fight against financial crimes, the government has app...

The landscape of international cricket has been jolted by an extraordinary diplomatic and security r...

As India prepares for the unveiling of the Union Budget 2026 in February, policy circles and industr...

In a significant stride towards the full digitisation of Bangladesh's public transport infrastructur...

A significant fire has broken out at the Matarbari Ultra Super Critical Coal-Fired Power Project, a...