Khaborwala Online Desk

Published: 11 Feb 2026, 12:47 pm

The five-year Treasury bonds issued by the Government of Bangladesh demonstrated stability on Tuesday, signalling a steady market environment. Economists attribute this steadiness primarily to the central bank’s continued liquidity management and the relatively stable exchange rate of the US dollar against the Bangladeshi taka.

According to the latest auction data released by the Bangladesh Institute of Development (BID), the cut-off yield on the five-year bonds—commonly regarded as the effective interest rate—rose marginally to 10.32%, up slightly from 10.31% in the previous auction. Analysts explain that this minor uptick reflects the combined effect of consistent demand for low-risk government securities and the ample liquidity circulating in the economy.

A senior official from Bangladesh Bank noted, “With private-sector credit demand tapering slightly ahead of the national elections, banks are channeling their surplus funds into government-approved securities.”

As part of its foreign currency intervention, the central bank purchased a substantial volume of US dollars from the interbank market, helping to maintain domestic liquidity. The official further observed that the inflow of remittances from expatriates, coupled with dollar purchases, has enabled the government bond yields to remain steady.

On Tuesday, the government issued bonds worth BDT 20,000 crore, partially aimed at bridging the fiscal deficit. Several commercial banks participated in the auction, seeking a secure avenue for investing their excess funds.

Economists and banking experts emphasise that monitoring liquidity flows and foreign exchange interventions is particularly crucial in the pre-election period. The combination of sufficient liquidity and cautious investor sentiment reduces the likelihood of significant short-term volatility in the government bond market.

Summary of Tuesday’s Bond Auction and Foreign Exchange Intervention

| Instrument | Amount Raised (BDT) | Cut-Off Yield (%) | Central Bank USD Purchase (Million USD) | Comments |

|---|---|---|---|---|

| 5-Year BGTB | 20,000,000,000 | 10.32 | 171 | Strong bidding amid limited private credit demand |

| Central Bank FX Intervention | – | – | 171 | USD purchased from 11 banks to stabilise USD/BDT |

Economists caution that pre-election monitoring of liquidity and foreign currency interventions is of heightened importance. In this context, the risk of substantial fluctuations in the government bond market remains low. The combination of disciplined investor behaviour, steady remittance flows, and proactive central bank measures underpins the current stability in yields.

Border Guard Bangladesh (BGB) has recovered a significant cache of foreign and locally manufactured...

In Feni, a significant number of firearms looted from police stations after 5 August remain unaccoun...

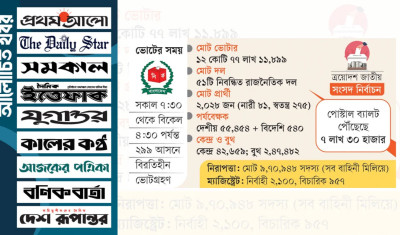

Comprehensive security arrangements have been finalised in Lalmonirhat district ahead of the 13th Na...

A housewife in Megha’s Potol village under Bhuapur upazila of Tangail has alleged that she was sexua...

As part of heightened security arrangements ahead of the 13th National Parliamentary Election, the i...

Bangladesh stands on the threshold of a pivotal democratic milestone, with the 13th National Parliam...

Early Wednesday morning, a fruit-laden truck overturned on the Dhaka–Mawa Expressway in the Hasara a...

Law enforcement authorities arrested Belal Uddin, the district chief of Jamaat-e-Islami in Thakurgao...

A delegation from the European Union (EU) Parliament held a key meeting with Chief Election Commissi...

In preparation for the 13th National Parliament elections and associated referendum, Dhaka has witne...

During the four-day voting holiday for the 13th National Parliamentary Election, a significant exodu...

In a worrying security breach, CCTV cameras were reported stolen from the polling centre at Bairag G...