Khaborwala online desk

Published: 29 Jan 2026, 05:40 pm

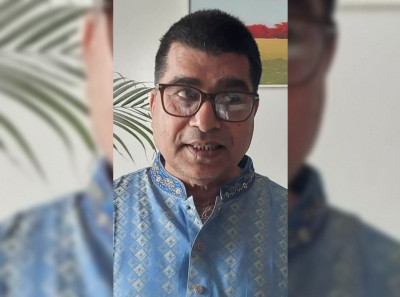

Deposit holders of the newly formed Sammlito Islami Bank will soon be able to withdraw their profits on a monthly basis, Bangladesh Bank Governor Dr Ahsan H. Mansur announced on Thursday. The facility will apply not only to savings and current accounts but also to fixed deposits, allowing withdrawals of up to BDT 2 lakh per account. The measure is expected to take effect from February.

In addition, profits earned from remittances and savings certificates can now be withdrawn immediately, offering greater flexibility to depositors. Governor Mansur shared these updates during a press conference organised by Bangladesh Bank.

“All depositors’ principal amounts are fully secure,” he emphasised. “Despite any rumours or misinformation, funds will be returned gradually as planned.”

Governor Mansur also addressed concerns regarding misinformation surrounding Sammlito Islami Bank, which was created by consolidating five struggling Islamic banks. He noted that some parties are attempting to undermine the bank’s operations for vested interests.

“No implementation plan is flawless from the start,” he added. “Problems are identified and resolved gradually. Some actors, however, are deliberately trying to obstruct the process.”

Currently, depositors can withdraw a maximum of BDT 2 lakh from any scheme. Profit rates have been standardised across the market since 1 January. Fixed deposits of more than one year now carry a profit rate of 9.5%, while deposits of less than one year yield 9%.

Governor Mansur further highlighted the government’s support: a 4% subsidy for two years, amounting to approximately BDT 4,500 crore, underscores the state’s commitment to safeguarding depositors’ interests.

Sammlito Islami Bank was established after the government merged Exim Bank, Social Islami Bank, First Security Islami Bank, Global Islami Bank, and Union Bank, all weakened by loan defaults and financial irregularities. Collectively, these banks held deposits of BDT 1.42 lakh crore from around 7.6 million depositors, with 77% of the BDT 1.92 lakh crore in loans now classified as non-performing.

Sammlito Islami Bank: Key Data

| Parameter | Details |

|---|---|

| Total Depositors | 7.6 million |

| Total Deposits | BDT 1.42 lakh crore |

| Total Loans | BDT 1.92 lakh crore |

| Non-Performing Loans | 77% of total loans |

| Fixed Deposit Profit Rate (>1 year) | 9.5% |

| Fixed Deposit Profit Rate (<1 year) | 9% |

| Maximum Withdrawal per Account | BDT 2 lakh |

| Government Subsidy | 4% for 2 years (~BDT 4,500 crore) |

Governor Mansur concluded that depositors’ welfare remains the top priority and urged the public not to be swayed by rumours, assuring that the bank is now on a secure footing.

London was swept up in the spiritual rhythms of Baul music as celebrated Bangladeshi singer Sharmin...

A tragic accident occurred on Thursday morning (29 January) at Patgram railway station in Lalmonirha...

In a startling administrative lapse, three individuals accused in a murder case were mistakenly rele...

In an unusual electoral pledge that has captured widespread attention on social media, independent c...

In a significant political development, thirteen senior leaders of the National Citizens’ Party (NCP...

Pakistan’s First Law MinisterIn South Asian political history, there are figures whose lives read li...

The High Court has ordered the seizure of properties and the freezing of bank accounts belonging to...

The High Court has dismissed a writ petition seeking to postpone the preliminary examination of the...

JASAD Central Committee Expresses Deep Condolences on the Passing of Adv. Masud Parvez NaushadThe Ja...

The status of Pakistan’s participation in the upcoming ICC T20 World Cup remains uncertain, with add...

Cybersecurity researchers have identified a new form of malware targeting Android devices that not o...

In Homna, a police case has been filed against 215 members of the BNP and its affiliated organisatio...