khaborwala online desk

Published: 06 Feb 2026, 09:14 pm

India is set to modernise the way banks contribute to deposit insurance by replacing its long-standing flat-rate premium with a risk-sensitive framework from 1 April, in a move designed to reward prudence and strengthen financial stability. The Reserve Bank of India (RBI) said the new regime will be administered by the Deposit Insurance and Credit Guarantee Corporation (DICGC), aligning premiums more closely with each lender’s financial soundness and supervisory profile.

For more than six decades, India has operated a uniform pricing system for deposit insurance. Since 1962, banks have paid the same levy irrespective of their risk profile, currently fixed at 12 paise per 100 rupees of assessable deposits. While administratively straightforward, the approach failed to distinguish between institutions that managed risk well and those that did not. Policymakers argue that such uniformity dulled incentives for stronger governance, prudent lending and robust capital buffers, while implicitly cross-subsidising weaker institutions.

Under the new framework, premiums will be calibrated using a composite assessment of financial and supervisory indicators. These include capital adequacy, asset quality (notably the level of impaired loans), earnings performance, liquidity resilience, and an estimate of the potential loss a bank’s failure could impose on the deposit insurance fund. By linking contributions to these metrics, the RBI aims to embed market-style discipline into a statutory safety net, encouraging banks to improve balance-sheet quality and risk controls in order to benefit from lower premiums.

Two risk assessment models will apply. A Tier 1 model will cover scheduled commercial banks, excluding regional rural banks, reflecting their scale and systemic relevance. A Tier 2 model will be used for regional rural banks and co-operative banks, recognising their distinct business models and data availability. To avoid abrupt shocks to funding costs, premium adjustments will be capped: the risk-based incentive (or surcharge) is limited to 33.33 per cent relative to the card rate. In addition, banks may qualify for a “vintage” incentive of up to 25 per cent if they have contributed to the insurance fund over a longer period without triggering major claims. The effective premium will reflect both adjustments applied to the base rate.

Certain institutions will transition more gradually. Payments banks and local area banks will continue to pay the card rate for now because of data limitations. Urban co-operative banks currently under supervisory or corrective action will be incorporated into the new framework once they exit such restrictions.

The reform mirrors international practice, where risk-based deposit insurance pricing is widely used to discourage excessive risk-taking and protect insurance funds from adverse selection. Over time, the RBI expects the new regime to sharpen incentives for better governance, bolster the resilience of the DICGC fund, and enhance depositor confidence by aligning contributions with risk.

Key Features of India’s New Deposit Insurance Premium Regime

| Feature | Previous System | New Framework (from 1 April) |

|---|---|---|

| Pricing method | Flat rate for all banks | Risk-based premiums |

| Base (“card”) rate | 12 paise per ₹100 of assessable deposits | Retained as reference |

| Risk indicators | Not applied | Capital strength, asset quality, earnings, liquidity, potential fund loss |

| Assessment models | Single approach | Tier 1 (scheduled commercial banks, excl. RRBs); Tier 2 (RRBs, co-operatives) |

| Premium adjustment cap | Not applicable | Up to ±33.33% vs card rate |

| Vintage incentive | Not available | Up to 25% discount |

| Transitional treatment | Not applicable | Payments & local area banks stay on card rate; urban co-ops join after restrictions lifted |

By recalibrating contributions to reflect risk, India’s central bank is seeking to modernise a legacy framework and align depositor protection with incentives for safer banking practices across the system.

Singapore’s property sector is undergoing a significant transformation, with escalating house prices...

India produced a commanding batting display in the ICC Under-19 World Cup final at Harare Sports Clu...

French striker Karim Benzema made an instant impact after joining Saudi Arabian giants Al Hilal, ann...

International commodity markets experienced significant declines on Thursday (5 February), with gold...

_1770383365.png)

Professor Donald Earl Collins of American University in Washington, D.C., has warned that under Pres...

In a strategic move ahead of the upcoming Pakistan Super League (PSL) auction, Lahore Qalandars have...

Mooresville, United States, 5 February 2026 – As healthcare costs continue to escalate and subsidies...

Leicester City, once the fairy-tale champions of English football, now face the very real prospect o...

In a shocking act of violence, Lucky Oberoi, a prominent leader of the Aam Aadmi Party (AAP), was sh...

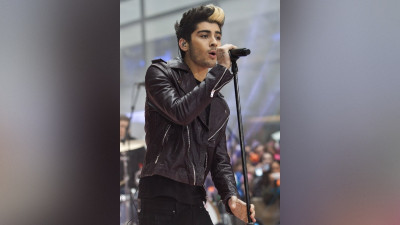

British singer-songwriter Zayn Malik has revealed plans for his most ambitious solo undertaking to d...

In the stark, wind-scoured cold desert of Spiti Valley in Himachal Pradesh, the snow leopard was onc...

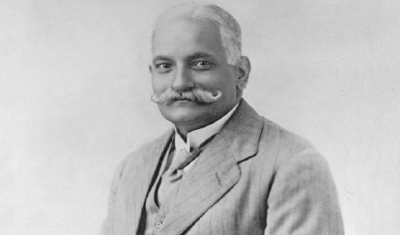

Motilal Nehru stands among the formative figures of India’s freedom struggle: a brilliant barrister,...