Published: 11 Jan 2026, 08:35 am

In recent months, government borrowing from the banking system has surged significantly, pushing total outstanding loans beyond six lakh crore taka for the first time. While the early months of the current fiscal year showed a relatively stable position, borrowing pressures increased sharply in November and December. According to the latest data from Bangladesh Bank, this rise reflects a substantial shift in the government’s cash management and fiscal financing strategies.

During the first four months of the fiscal year, the government was a net payer to banks, repaying more than it borrowed. Net repayments in this period amounted to 5.03 billion taka. However, the trend reversed in the final two months of the calendar year. From the start of the fiscal year to 4 January, the government borrowed nearly 60,000 crore taka from banks, bringing total outstanding bank debt to 6.10 lakh crore taka.

Each year, the government sets borrowing targets from both banks and national savings instruments to bridge the budget deficit. In the current fiscal year, the target for bank borrowing is 1.04 lakh crore taka, while borrowing from savings certificates is capped at 12,500 crore taka. By comparison, the previous fiscal year’s original budget set a bank borrowing target of 1.375 lakh crore taka, later revised to 99,000 crore taka, with actual borrowing amounting to 72,372 crore taka.

A similar discrepancy was observed in the savings instrument sector. Last year, the target was 15,400 crore taka, but actual borrowing fell to just 6,063 crore taka. In the current fiscal year, reliance on savings instruments has increased again. Between July and October, borrowing from this sector rose by 2,369 crore taka, lifting total debt from savings certificates to 3.41 lakh crore taka.

Bangladesh Bank data shows that as of 4 January, government borrowing from the central bank reached 1,22,429 crore taka, up from 98,424 crore taka at the end of June, an increase of 24,006 crore taka. Borrowing from commercial banks also rose to 4,88,232 crore taka, up by 35,751 crore taka over the same period.

The table below summarises the government’s bank borrowing position:

| Source of Borrowing | End-June Outstanding (crore taka) | Outstanding as of 4 Jan (crore taka) | Increase (crore taka) |

|---|---|---|---|

| Central Bank | 98,424 | 1,22,429 | 24,006 |

| Commercial Banks | 4,52,481 | 4,88,232 | 35,751 |

| Total | 5,50,905 | 6,10,661 | 59,756 |

Monthly trends indicate that government bank debt had declined to 5,50,502 crore taka by October. Within the next two months, it rose sharply to 5,96,144 crore taka by mid-December and has since increased further.

Senior officials at Bangladesh Bank attribute this surge to several factors. In early December, the government injected approximately 20,000 crore taka in capital into a newly consolidated Islamic bank formed through the merger of five institutions. At the same time, revenue collection has fallen short of expectations, while operational and development expenditures have increased. These combined pressures have heightened the government’s dependence on bank financing, raising concerns about liquidity conditions and the potential impact on private sector credit.

The fierce competition for admission to Rajshahi University has officially commenced, with thousands...

Nagad Limited, a leading mobile-based digital financial services provider in Bangladesh, has announc...

Popular Bangladeshi singer and composer Pritom Hasan recently stirred curiosity across social media...

By ABM Zakirul Haque TitonIn the history of Bangladesh’s national parliamentary elections, women vot...

Ibrahim Ahmed Kamal, the veteran guitarist of the iconic Bangladeshi rock band Warfaze, has offered...

Gazipur, Bangladesh – In a startling discovery early on Friday morning, law enforcement authorities...

Premier Bank PLC has officially announced a high-profile vacancy in its FVP-VP division, inviting ap...

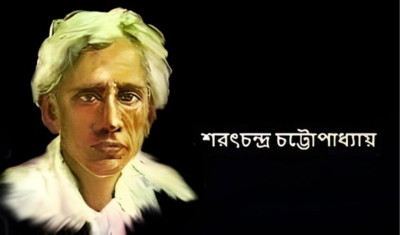

BELUR, West Bengal, 16 January 2026 — Today marks the death anniversary of one of Bengali literature...

BEL AIR, Md., 15 January 2026 — Harford Mutual Insurance Group (HMIG) has announced that it donated...

The Life Insurance Association of Japan (LIAJ) has outlined three strategic priorities for the natio...

Australian life insurance consumers have faced repeated double-digit increases in their premiums in...

Uttara, Dhaka – A devastating fire in a six-storey residential building in Uttara, Dhaka, has claime...