Published: 07 Feb 2026, 05:08 am

Bangladesh has witnessed an extraordinary surge in inward remittances during the opening days of February 2026. According to the latest data released by Bangladesh Bank, the nation’s central financial authority, a staggering ৳6,173 crore (equivalent to $506 million) was funnelled into the country in only the first four days of the month.

This rapid influx suggests a significant acceleration in capital transition as the nation approaches a critical general election. Historically, such high-velocity transfers are reserved for major religious festivals, making this concentrated four-day burst a notable anomaly in recent financial cycles.

When measured against the same four-day window in February 2025—which saw an inflow of approximately ৳5,145 crore ($422 million)—the current figures represent a sharp 19.8% increase. The sheer scale of this growth over such a brief duration indicates a heightened level of liquidity and urgency among the Bangladeshi diaspora.

Senior banking officials suggest that while traditional family support remains a factor, the looming election is the primary engine behind this trend. Candidates and political organisers are reportedly mobilising offshore funds to meet the intensive costs associated with campaigning. These funds, often raised by supporters abroad, are entering the domestic economy as formal remittances, a trend expected to persist until the polls conclude.

The following table highlights the monthly trajectory of inflows leading up to this recent four-day peak:

| Month | Remittance (USD Billions) | Approx. Value (BDT Crore) | Market Context |

|---|---|---|---|

| July 2025 | $2.48 | ৳30,240 | Stable fiscal start |

| August 2025 | $2.42 | ৳29,510 | Marginal dip |

| November 2025 | $2.89 | ৳35,240 | Election buildup begins |

| December 2025 | $3.22 | ৳39,265 | Sharp year-end rise |

| January 2026 | $3.17 | ৳38,655 | Sustained high volume |

| Feb 1–4, 2026 | $0.51 | ৳6,173 | Unprecedented 4-day surge |

The impact of this ৳6,173 crore injection extends far beyond immediate political spending. Throughout the calendar year 2025, Bangladesh secured a total of $32.82 billion (approx. ৳4 lakh crore) in remittances. Remarkably, this cumulative figure almost mirrors the total foreign exchange reserves currently held by the central bank.

This steady supply of "greenback" liquidity has effectively shielded the domestic market from the chronic dollar shortages that plagued the economy in previous years. To maintain a balanced currency market and curb volatility, Bangladesh Bank has been proactive in purchasing foreign currency from commercial banks. This intervention has not only stabilised the Taka but has also allowed for a gradual rebuilding of the nation's forex reserves, providing a vital cushion against global economic shocks.

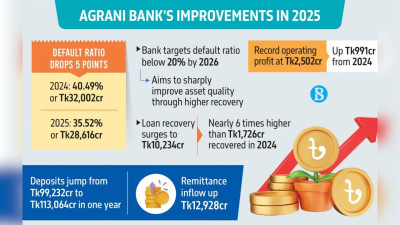

In a significant turnaround for Bangladesh’s financial sector, the state-owned Agrani Bank PLC has r...

In a landmark development for South-South cooperation, Bangladesh and the Caribbean nation of Grenad...

In a contest that seemed destined to conclude in the shadows of a clinical Dhumketu XI performance,...

The first week of February 2026 has proven to be a transformative period for the global insurance an...

The Bangladeshi academic community is in mourning following the passing of Meherunnessa Chowdhury, a...

The bustling streets of Dhaka and the salt-sprayed air of Chattogram have long been the twin backdro...

Singapore’s property sector is undergoing a significant transformation, with escalating house prices...

India is set to modernise the way banks contribute to deposit insurance by replacing its long-standi...

International commodity markets experienced significant declines on Thursday (5 February), with gold...

For the first time in Bangladesh’s history, a band is set to receive the prestigious Ekushey Padak,...

Renowned singer Subir Nandi, who passed away in Singapore in 2020 while undergoing medical treatment...

Mooresville, United States, 5 February 2026 – As healthcare costs continue to escalate and subsidies...