Published: 07 Feb 2026, 06:19 am

The first week of February 2026 has proven to be a transformative period for the global insurance and financial services landscape. From high-stakes acquisition talks in Europe to strategic bancassurance expansions in Asia, the sector is currently undergoing a period of intense consolidation and digital evolution.

The headline development of the week is Zurich Insurance Group’s move to acquire the specialist insurer Beazley plc. The proposed cash offer, which has been agreed upon in principle, values Beazley at approximately $11.0 billion (£8.0 billion). This deal represents a significant play for Zurich to bolster its specialist underwriting capabilities.

Under the current proposal, Beazley shareholders are set to receive up to 1,335 pence per share. This package consists of a 1,310p cash component and a further 25p in permitted dividends, provided they are settled before the finalisation of the merger.

In the Middle East, MS Amlin has deepened its ties with its parent company, Mitsui Sumitomo Insurance (MSI). Operating through its Dubai branch, the firm has launched a reinsurance partnership designed to offer contract frustration protection specifically for MSI’s banking clientele within the United Arab Emirates.

Meanwhile, leadership changes are afoot at Aon Plc. The global professional services firm has appointed Karl Hamann as the new CEO for the Philippines, effective 1 April. Hamann will relocate to Manila to spearhead operations under the direction of Andrew Minnitt, Aon’s Head of Southeast Asia.

| Entity | Action | Market/Region |

|---|---|---|

| Zurich Insurance | Proposed £8bn buyout of Beazley plc | United Kingdom / Global |

| MS Amlin | Reinsurance tie-up with MSI | United Arab Emirates |

| Bharti AXA Life | Bancassurance with Equitas SFB | India |

| Aon Plc | Karl Hamann appointed CEO | Philippines |

| PDIC (Philippines) | Cooperation MOU with DICoM | Mongolia |

The digital frontier saw a major breakthrough in Singapore. The Infocomm Media Development Authority (IMDA) confirmed that four digital trade platforms—AEOTrade, BlockPeer, Credore, and SGTraDex—have received approval from the International Group of Protection and Indemnity Clubs. This move signifies the maritime insurance industry’s acceptance of electronic Bills of Lading, a crucial step in modernising global trade documentation.

In the retail sector, Bharti AXA Life Insurance has joined forces with Equitas Small Finance Bank. This bancassurance push is specifically targeted at India’s semi-urban and rural heartlands, aiming to bridge the protection gap in traditionally underserved markets.

In a significant move to fortify the financial ecosystems available to the affluent, CapBridge has e...

While United Kingdom Prime Minister Sir Keir Starmer has never been directly linked to the disgraced...

As the cold winds whistle through Turf Moor ahead of a decisive clash with West Ham United, the mood...

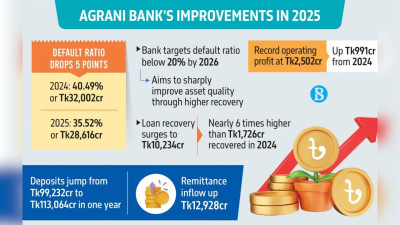

In a significant turnaround for Bangladesh’s financial sector, the state-owned Agrani Bank PLC has r...

The global cultural phenomenon known as Lisa (Lalisa Manobal) is further cementing her transition fr...

While the Great Pyramids of Giza have long captivated the global imagination, a similarly awe-inspir...

For Xavi Simons, the turning point arrived with the cold clarity of a winter’s evening. On 10 Januar...

England’s Test captain, Ben Stokes, has suffered significant facial injuries after being struck by a...

Bangladesh has witnessed an extraordinary surge in inward remittances during the opening days of Feb...

Singapore’s property sector is undergoing a significant transformation, with escalating house prices...

India is set to modernise the way banks contribute to deposit insurance by replacing its long-standi...

India produced a commanding batting display in the ICC Under-19 World Cup final at Harare Sports Clu...