Published: 07 Feb 2026, 07:12 am

In a significant move to fortify the financial ecosystems available to the affluent, CapBridge has entered into a strategic partnership with AIA Singapore. This collaboration is designed to integrate bespoke insurance solutions into the digital investment sphere, specifically targeting the nuanced requirements of high-net-worth (HNW) individuals and family offices.

Under the terms of this new alliance, CapBridge will utilise its proprietary digital investment platform to distribute AIA’s customised insurance products. This integration marks a shift in the fintech landscape, moving away from purely transactional investment services toward a "holistic" wealth management model. By blending traditional asset growth with sophisticated protection mechanisms, the partnership addresses a critical gap in the digital wealth journey: legacy planning.

The suite of products introduced through this venture is meticulously engineered to support estate planning and long-term financial security. It provides a safety net that operates in tandem with CapBridge’s existing private market investments and advisory services.

According to CapBridge, this expansion is a direct response to a fundamental shift in client appetites. Modern investors are increasingly pivoting from a singular focus on capital gains toward a more defensive posture that prioritises asset preservation. In an era of global economic volatility, the ability to ensure a seamless transfer of wealth across generations has become a primary objective for the modern patriarch or matriarch.

"Investors are no longer merely seeking the highest possible returns; they are looking for a comprehensive strategy that safeguards their achievements," a spokesperson noted. By embedding AIA’s insurance expertise into a digital-first platform, the duo aims to provide a seamless, end-to-end experience for the sophisticated investor.

| Feature | Traditional Investment Platforms | CapBridge x AIA Integrated Model |

|---|---|---|

| Primary Focus | Capital Appreciation & Trading | Wealth Protection & Legacy Planning |

| Asset Classes | Public/Private Equities | Equities + Bespoke Life/Estate Insurance |

| Succession Support | Minimal/External Referral | Built-in Estate Planning Frameworks |

| Risk Management | Portfolio Diversification | Diversification + Guaranteed Indemnity |

| Delivery Method | Disparate Advisory Services | Unified Digital Wealth Dashboard |

The partnership is poised to set a new benchmark for Singapore’s burgeoning fintech hub. By offering high-value insurance products—traditionally the domain of face-to-face private banking—within a digital ecosystem, CapBridge and AIA are effectively democratising access to complex financial instruments.

As the HNW segment continues to grow across Asia, the demand for such integrated solutions is expected to rise. This collaboration ensures that clients can manage their risk profiles and inheritance strategies with the same level of digital agility they apply to their venture capital or private equity holdings.

Midland Bank PLC has successfully convened its Annual Business Conference 2026, a full-day strategic...

While United Kingdom Prime Minister Sir Keir Starmer has never been directly linked to the disgraced...

As the cold winds whistle through Turf Moor ahead of a decisive clash with West Ham United, the mood...

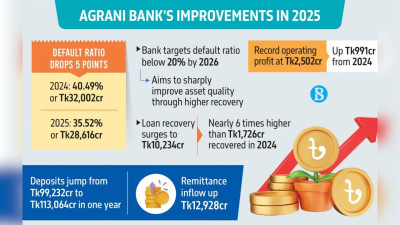

In a significant turnaround for Bangladesh’s financial sector, the state-owned Agrani Bank PLC has r...

The first week of February 2026 has proven to be a transformative period for the global insurance an...

The global cultural phenomenon known as Lisa (Lalisa Manobal) is further cementing her transition fr...

While the Great Pyramids of Giza have long captivated the global imagination, a similarly awe-inspir...

For Xavi Simons, the turning point arrived with the cold clarity of a winter’s evening. On 10 Januar...

England’s Test captain, Ben Stokes, has suffered significant facial injuries after being struck by a...

Bangladesh has witnessed an extraordinary surge in inward remittances during the opening days of Feb...

Singapore’s property sector is undergoing a significant transformation, with escalating house prices...

India is set to modernise the way banks contribute to deposit insurance by replacing its long-standi...