Khaborwala Online Desk

Published: 07 Feb 2026, 08:43 am

Midland Bank PLC has successfully convened its Annual Business Conference 2026, a full-day strategic forum aimed at defining the bank’s direction for the year ahead. Held on 6 February 2026, the conference brought together the institution’s top leadership, heads of divisions, branch and sub-branch managers, and representatives from key business units. The overarching objective was to review recent operational performance, scrutinise the proposed 2026 budget, and agree on strategic priorities aligned with sustainable growth, regulatory discipline, and long-term value creation.

The conference was formally inaugurated and chaired by the Managing Director and Chief Executive Officer, Md. Ahsan-uz-Zaman. In his opening address, he underscored the importance of balanced expansion, prudent risk management, and a customer-centric service model. He noted that in an increasingly competitive and compliance-driven banking environment, strong corporate governance and long-term strategic planning are indispensable for stability and success. Independent Director Riaz Ahmed Chowdhury attended as a special guest, lending additional strategic and governance perspective to the deliberations.

Senior members of management were present throughout the sessions, including Deputy Managing Director and Chief Risk Officer Md. Zahid Hossain, and Deputy Managing Director, Head of Information Technology and CRO Md. Nazmul Huda Sarkar. Their participation, alongside divisional heads and the Chief Executive Officer of Midland Bank Asset Management Company Limited, reinforced the inclusive and cross-functional nature of the conference.

Chief Financial Officer Didarul Islam delivered a comprehensive presentation on the bank’s overall financial position, highlighting income and expenditure trends, recent achievements, and areas requiring further improvement. This was followed by detailed presentations from the Head of Institutional Banking, Md. Javed Tareq Khan, as well as the heads of SME Banking and Treasury, each outlining divisional performance and forward-looking business plans. The activities and strategic outlook of the ID Division were presented separately by Khandaker Toufiq Hossain.

Extensive discussions were held on the bank’s core business segments, including Institutional Banking, SME, Treasury, ID, and Expatriate Banking. Particular emphasis was placed on the proposed 2026 budget, which balances ambitious growth targets with a strong focus on asset quality, capital adequacy, and regulatory compliance. Participants analysed market conditions, credit risk trends, and opportunities for portfolio optimisation in line with the bank’s risk appetite.

A dedicated session on Retail Banking was conducted by Md. Rashed Akter, Head of Retail Distribution and Chief Bancassurance Officer. Officials from branches, sub-branches, agent banking, cards, digital services, Islamic banking windows, and bancassurance took part. The session fostered inter-departmental coordination and data-driven analysis, especially in relation to service quality, sales effectiveness, and digital transformation.

Key Business Areas Reviewed

| Business Segment | Primary Focus Areas |

|---|---|

| Institutional Banking | Performance evaluation and growth strategy |

| SME Banking | Portfolio quality and measured expansion |

| Treasury | Market outlook and risk management |

| Retail & Branch Banking | Service standards and sales productivity |

| Agent & Islamic Banking | Financial inclusion and compliance |

| Cards & Digital Services | Product innovation and digital transformation |

| Expatriate Banking | Remittance growth and relationship strengthening |

In his closing remarks, the Managing Director urged all officials to adhere strictly to regulatory guidelines, accelerate the recovery of non-performing loans, and ensure sustainable profitability for shareholders. The conference concluded with an awards segment recognising top performers across various categories, reinforcing a culture of accountability, motivation, and professional excellence within Midland Bank.

Singapore’s property insurance sector is poised for sustained growth over the coming years, driven p...

Seven years after his passing, the immortal voice and guitar virtuoso of Bangladesh’s band music, Ay...

In a significant move to fortify the financial ecosystems available to the affluent, CapBridge has e...

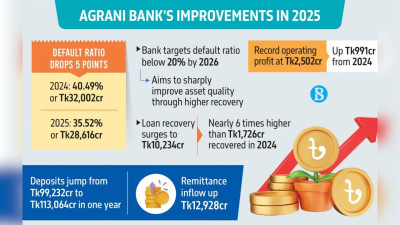

In a significant turnaround for Bangladesh’s financial sector, the state-owned Agrani Bank PLC has r...

In a landmark development for South-South cooperation, Bangladesh and the Caribbean nation of Grenad...

In a contest that seemed destined to conclude in the shadows of a clinical Dhumketu XI performance,...

The first week of February 2026 has proven to be a transformative period for the global insurance an...

Bangladesh has witnessed an extraordinary surge in inward remittances during the opening days of Feb...

The Bangladeshi academic community is in mourning following the passing of Meherunnessa Chowdhury, a...

The bustling streets of Dhaka and the salt-sprayed air of Chattogram have long been the twin backdro...

Singapore’s property sector is undergoing a significant transformation, with escalating house prices...

India is set to modernise the way banks contribute to deposit insurance by replacing its long-standi...