Khaborwala Online Desk

Published: 07 Feb 2026, 10:23 am

Singapore’s property insurance sector is poised for sustained growth over the coming years, driven primarily by rising residential property values, robust housing transactions, and evolving technological and regulatory frameworks, industry experts have said.

According to GlobalData, Singapore’s property insurance market is projected to expand by 6.3% in 2026. In 2025, the sector accounted for 19% of total general insurance premiums, making it the country’s third-largest insurance segment. Analysts anticipate that by 2030, total premiums could surpass USD 1.2 billion, further enhancing the market’s financial significance.

Residential property transactions are a central growth driver. The Housing & Development Board (HDB) has forecast that resale flats and private residential developments will continue to experience an upward trend through 2026. In 2025, 10,815 private residential units were sold—the highest in recent years. Although mid-year global economic uncertainties and changes in U.S. trade policies temporarily slowed transactions, lower interest rates towards year-end spurred a strong market recovery.

High-value residential properties have also contributed significantly to rising insurance demand. In Q3 2025, transactions exceeding USD 5 million grew by 20%, driving demand for customised insurance policies. Standard coverage is often insufficient for luxury homes, prompting homeowners to seek comprehensive protection.

Regulatory changes have further influenced insurance uptake. In July 2025, Singapore extended the minimum property holding period from three to four years and increased stamp duties for sellers at all levels. These measures are expected to encourage broader adoption of full home insurance policies over short-term fire-only coverage.

Digital distribution is emerging as another key factor. In 2026, online sales of home insurance are expected to accelerate, with several rental platforms already integrating basic home insurance into their packages, offering convenience and accessibility to consumers.

Key Singapore Property Insurance Indicators

| Indicator | 2025 | 2026 Forecast | 2030 Projection |

|---|---|---|---|

| Market Growth | – | 6.3% | – |

| Total Premium | – | – | USD 1.2B |

| Share of General Insurance | 19% | – | – |

| Private Residential Price Growth | – | 2–4% | – |

| Private Rent Growth | – | Up to 2% | – |

| High-Value Transactions (>$5M) | – | – | – |

Analysts believe that insurers expanding digital and embedded distribution channels while simplifying claims processes will be best positioned to capture a larger market share in Singapore’s property insurance sector over the next decade.

Sonali Life Insurance Company Limited has once again reinforced its leadership position within Bangl...

The Pokhara Rangshala Stadium is set to host a thrilling climax to the SAFF U19 Women’s Championship...

On the eve of the ICC T20 World Cup, both India and Sri Lanka have faced unexpected setbacks, forcin...

Pakistan embarks today on its long-awaited ICC T20 World Cup campaign, entering a phase where victor...

Midland Bank PLC has successfully convened its Annual Business Conference 2026, a full-day strategic...

In a significant move to fortify the financial ecosystems available to the affluent, CapBridge has e...

While United Kingdom Prime Minister Sir Keir Starmer has never been directly linked to the disgraced...

As the cold winds whistle through Turf Moor ahead of a decisive clash with West Ham United, the mood...

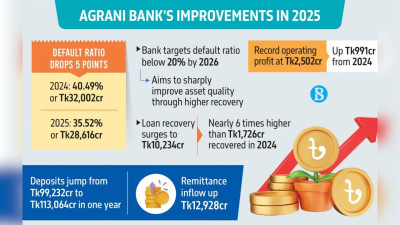

In a significant turnaround for Bangladesh’s financial sector, the state-owned Agrani Bank PLC has r...

The first week of February 2026 has proven to be a transformative period for the global insurance an...

The global cultural phenomenon known as Lisa (Lalisa Manobal) is further cementing her transition fr...

While the Great Pyramids of Giza have long captivated the global imagination, a similarly awe-inspir...