Published: 07 Feb 2026, 06:45 am

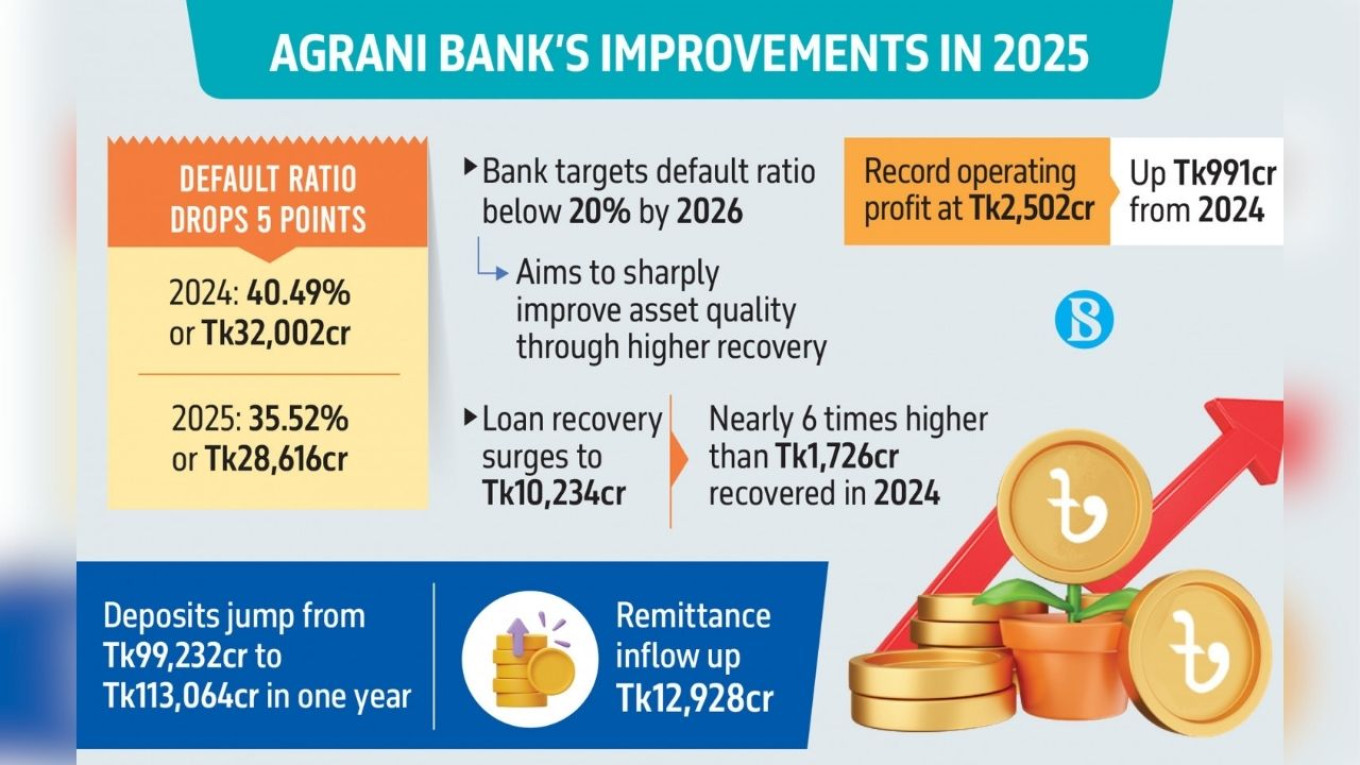

In a significant turnaround for Bangladesh’s financial sector, the state-owned Agrani Bank PLC has reported a substantial reduction in its non-performing loans (NPLs) for the 2025 fiscal year. The bank successfully shed Tk3,584 crore from its defaulted loan portfolio, marking a pivotal moment in the government's broader strategy to sanitise the balance sheets of public sector banks and restore institutional stability.

The bank’s Managing Director, Md Anwarul Islam, revealed these figures during a press briefing yesterday, attributing the success to a series of aggressive recovery initiatives launched under his leadership. By the close of 2025, the volume of defaulted loans had fallen from Tk32,002 crore (representing 40.49% of the total loan book) to Tk28,616 crore, bringing the default ratio down to 35.52%.

Islam expressed cautious optimism regarding the trajectory, stating, "We are beginning to reap the rewards of our strategic interventions. However, the journey is far from over. Our ultimate mandate is to drive the default ratio below the 20% threshold by the end of 2026."

The fiscal year 2025 was also a year of record-breaking performance in other key metrics. Driven primarily by the surge in loan recoveries, Agrani Bank posted the highest operating profit in its history, reaching Tk2,502 crore—a remarkable 65% increase over the previous year's Tk1,511 crore.

Total deposits also saw a healthy climb, rising by Tk13,832 crore to reach a total of Tk113,064 crore. This growth suggests a bolstering of public confidence in the state-run lender despite the wider challenges facing the national economy.

| Metric | 2024 (Actual) | 2025 (Actual) | Change (Value) |

|---|---|---|---|

| Defaulted Loans | Tk32,002 cr | Tk28,616 cr | -Tk3,584 cr |

| Default Ratio | 40.49% | 35.52% | -4.97% |

| Total Deposits | Tk99,232 cr | Tk113,064 cr | +Tk13,832 cr |

| Operating Profit | Tk1,511 cr | Tk2,502 cr | +Tk991 cr |

| Remittance Inflow | Tk21,033 cr | Tk33,961 cr | +Tk12,928 cr |

| Import Volume | Tk50,588 cr | Tk54,367 cr | +Tk3,779 cr |

The bank’s recovery of Tk10,234 crore from defaulters in 2025—compared to a mere Tk1,726 crore in 2024—was achieved through a multifaceted approach:

Cash Recoveries: Tk1,009 crore was reclaimed in direct cash payments.

Rescheduling: Tk8,368 crore was regularised through debt restructuring and rescheduling agreements.

Written-off Loans: Tk936 crore was successfully recovered from previously written-off accounts.

For the 2026 calendar year, the bank has set a combined recovery target of Tk12,200 crore, reflecting an ambitious stance on asset quality improvement.

Agrani Bank remains a vital conduit for the nation's foreign exchange, recording a sharp rise in remittance inflows which hit Tk33,961 crore. On the trade front, while import handling grew to Tk54,367 crore, exports witnessed a slight contraction, falling by Tk862 crore to stand at Tk13,252 crore, reflecting shifting global demand and domestic production cycles.

In a significant move to fortify the financial ecosystems available to the affluent, CapBridge has e...

In a landmark development for South-South cooperation, Bangladesh and the Caribbean nation of Grenad...

In a contest that seemed destined to conclude in the shadows of a clinical Dhumketu XI performance,...

The first week of February 2026 has proven to be a transformative period for the global insurance an...

Bangladesh has witnessed an extraordinary surge in inward remittances during the opening days of Feb...

The Bangladeshi academic community is in mourning following the passing of Meherunnessa Chowdhury, a...

The bustling streets of Dhaka and the salt-sprayed air of Chattogram have long been the twin backdro...

Singapore’s property sector is undergoing a significant transformation, with escalating house prices...

India is set to modernise the way banks contribute to deposit insurance by replacing its long-standi...

International commodity markets experienced significant declines on Thursday (5 February), with gold...

For the first time in Bangladesh’s history, a band is set to receive the prestigious Ekushey Padak,...

Renowned singer Subir Nandi, who passed away in Singapore in 2020 while undergoing medical treatment...