khaborwala online desk

Published: 12 Feb 2026, 09:24 pm

Bangladesh has agreed to withdraw the long-standing requirement that non-life insurers cede at least 50 per cent of their reinsurance business to the state-owned Sadharan Bima Corporation (SBC), following a newly concluded reciprocal trade agreement with the United States. The decision marks a significant shift in the country’s insurance policy framework and is expected to reshape risk placement, competition, and the flow of premiums within the non-life insurance market.

Reinsurance—often described as “insurance for insurers”—enables primary insurance companies to spread large and volatile risks across multiple balance sheets, thereby safeguarding their ability to honour substantial claims arising from events such as factory fires, maritime cargo losses, industrial accidents, or natural disasters. Under existing legislation, at least half of such risk transfers were required to be placed with SBC, with the remainder allocated to domestic or international reinsurers. This arrangement effectively guaranteed SBC a dominant share of the domestic reinsurance market, while limiting the freedom of private insurers to diversify counterparties and pricing.

In November last year, the Financial Institutions Division (FID) proposed amending the Insurance Corporation Act 2019 to remove the mandatory cession clause. Although officials initially declined to elaborate on the rationale, senior policymakers have since acknowledged that the reform was pursued in response to demands from Washington as part of negotiations to reduce reciprocal tariffs on Bangladeshi exports to the United States. The US had initially threatened to impose tariffs of up to 37 per cent on Bangladeshi goods, later lowering the rate to 20 per cent with effect from August. Under the agreement signed on 9 February, the tariff rate was further reduced to 19 per cent, with regulatory concessions in services sectors, including insurance, forming part of the broader understanding.

Private insurers have broadly welcomed the move, arguing that compulsory cession constrained competition and efficiency. Several executives have cited persistent delays in the settlement of reinsurance claims by SBC, with some outstanding cases reportedly dating back to 2020. Such delays, they contend, have impaired liquidity and slowed compensation to policyholders, particularly following large industrial losses. Greater freedom to place reinsurance with a wider pool of counterparties is expected to enhance claims recovery, improve pricing discipline, and strengthen risk management practices through access to global capacity and expertise.

SBC, however, has expressed concern over the potential impact on its revenues and market position. In a letter to the FID, the state insurer warned that removing the mandatory cession could erode a stable source of premium income and weaken its capacity to play a counter-cyclical role during large loss events. The corporation’s recent financial performance reflects both resilience and vulnerability: while profitability improved year-on-year, market-linked investment losses weighed heavily on comprehensive income.

Sadharan Bima Corporation: Key Financial Indicators

| Indicator | FY 2023 | FY 2024 | Change |

|---|---|---|---|

| Net income after tax | Tk 262.5 crore | Tk 297.6 crore | +13% |

| Unrealised losses on shares | — | Tk 862 crore | — |

| Earnings per share (EPS) | Tk 52.51 | Tk 33.07 | −37% |

Policy analysts suggest that, while liberalising reinsurance placements may improve efficiency and integration with global markets, the transition should be accompanied by regulatory safeguards. These include strengthened capital adequacy requirements, robust supervision of cross-border reinsurance arrangements, and reforms within SBC to improve claims settlement, underwriting discipline, and investment governance. Balancing market liberalisation with the stability of the state insurer will be critical to ensuring that the reform enhances resilience rather than introduces new vulnerabilities into Bangladesh’s insurance system.

Remittance inflows to Bangladesh have risen sharply in the run-up to the national election, with exp...

An elected Union Parishad (UP) member was seriously injured in a machete attack while returning home...

In Barguna’s Taltali Upazila, a Union Parishad (UP) member, Ali Ahmad Farazi, was brutally assaulted...

The Legal Adviser of Bangladesh’s Interim Government, Asif Nazrul, has confirmed that the transfer o...

In the densely populated area of Banshal in Old Dhaka, the atmosphere on Thursday morning was animat...

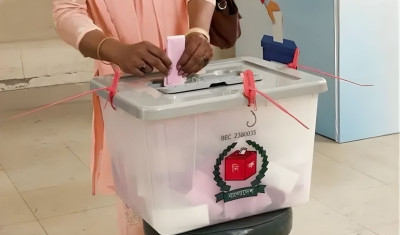

The Bangladesh Election Commission (EC) has reported that over 648,000 postal ballots submitted via...

Following the conclusion of polling in the 13th National Parliamentary Election and the concurrent r...

From the early hours of Thursday morning, citizens across the country, including the capital, flocke...

Dhaka, 12 February 2026 – Authorities at Shahbagh Metro Station apprehended a young man in possessio...

In a dramatic turn of events in the 13th National Parliamentary Elections, independent candidate and...

Bangladesh witnessed the culmination of the historic 13th National Parliamentary Election and nation...

Tragedy struck in Manikganj-1 constituency (Ghiur-Doulatpur-Shibaloy) on Thursday, 12 February, when...