Khaborwala online desk

Published: 11 Feb 2026, 06:37 pm

A significant number of middle-income American families are dedicating a substantial portion of their earnings to health insurance, according to a recent analysis by the Commonwealth Fund, a nonprofit research organisation specialising in health care.

The report reveals that in 2024, contributions to premiums and deductibles for family health plans amounted to 10% or more of the median household income in 19 states, excluding copayments. The financial burden was most acute in Southern states, highlighting regional disparities in health care costs.

The proportion of household income allocated to family coverage ranged from a low of 5.7% in the District of Columbia to a high of 15.6% in Louisiana. Florida, Mississippi, and North Carolina also topped 13%, making them among the most expensive states for working families.

| State | % of Median Household Income Spent on Family Coverage | Median Household Income (2024) |

|---|---|---|

| Louisiana | 15.6% | $65,400 |

| Florida | 13.7% | $70,700 |

| Mississippi | 13.7% | $55,980 |

| North Carolina | 13.7% | $74,200 |

| District of Columbia | 5.7% | $95,000 |

“Southern workers face some of the highest cost burdens because wages in the region are lower, so families spend a bigger share of their pay on employer coverage,” said Kristen Kolb, lead author of the report. “This leaves less room in household budgets for other necessities and can increase the risk that people delay or skip needed care.”

Approximately 167 million working-age adults under 65 in the United States receive health insurance through their own employer or a family member’s employer. While employers generally cover around 70% of the premium for family plans, employees shoulder the remainder, along with deductibles and copayments. On average, employees contributed $7,216 annually in 2024 towards a total average plan cost of $24,540.

Single coverage also carries significant costs. In 26 states, deductibles consumed 5% or more of median individual income, primarily in the Southeast and Midwest.

Health care expenses continue to rise sharply, with costs increasing by 6% in 2025 over the previous year and projections indicating further growth.

“Premiums and deductibles for many American workers can strain household budgets and raise the risk of medical debt or delayed care,” noted Sara Collins, senior scholar at the Commonwealth Fund. “Policymakers, employers, insurers, and providers all have roles to play in making health care more affordable.”

Meanwhile, some Americans are receiving less assistance. Enhanced tax credits for plans purchased through the Affordable Care Act marketplaces expired at the end of last year, leaving families to bear a greater share of health insurance costs.

_1770818299.png)

The late convicted sex offender Jeffrey Epstein was once known to have a cordial relationship with t...

In a shocking incident that has sent ripples through Mathura, Uttar Pradesh, the bodies of five memb...

Pop superstar Britney Spears has made headlines once again, but this time the spotlight is on a stra...

HONG KONG, 11 February — A Hong Kong magistrates’ court has convicted 69-year-old Kok Yin-sang of br...

Shariatpur, Bangladesh – In a significant law enforcement operation, a joint task force arrested a f...

_1770811661.png)

As the 2026 FIFA World Cup approaches, the United States government has announced a special initiati...

In a disturbing incident in Habiganj’s Baniachong Upazila, unknown miscreants attempted to set fire...

In a dramatic incident in Sirajganj-2, a local leader of the Islami Jamā‘at fled on foot after being...

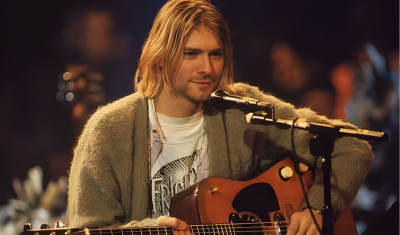

More than three decades after the tragic demise of Kurt Cobain, frontman of the iconic grunge band N...

Voting is a cornerstone of Bangladesh’s democratic framework, providing citizens with the fundamenta...

In the lead-up to the Thirteenth National Parliamentary Election, vehicular movement over the Jamuna...

_1770808648.png)

The political landscape at Spanish giants FC Barcelona has been stirred into motion following the re...