Khaborwala Online Desk

Published: 22 Jan 2026, 04:09 pm

The Insurance Development and Regulatory Authority (IDRA) of Bangladesh has introduced new regulations to cap the operational expenditures of foreign head offices in the country’s life insurance sector. The directive, published in the official Gazette on 13 January 2026, is formalised under Rule 4 of the Life Insurance Business Management Expenses Ceiling Rules, 2020, stipulating that expenses incurred by a foreign head office shall not exceed 3 per cent of net premiums.

The updated guidelines make it explicit that if a life insurance company conducts its principal business activities within Bangladesh, the expenses of its foreign head office will be counted as local operational costs rather than additional expenditures. Furthermore, any remittance of funds abroad now requires mandatory prior approval from IDRA, a measure aimed at enhancing financial oversight.

Previously, the 2020 iteration of the rules did not specify any ceiling for foreign head office expenses. Although the Insurance Act of 2010 mentioned such expenditures, it provided no fixed percentage or monetary limit. To address this regulatory gap, a special notification was issued on 19 May 2022, establishing maximum permissible rates for foreign head office expenses based on both first-time and renewal premiums.

The following table summarises the approved maximum expenditure rates from the 2022 notification:

| Premium Type | Premium Amount (BDT) | Maximum Expense Rate |

|---|---|---|

| First-time Premium | ≤ 2,000,000,000 | 1.00% |

| First-time Premium | 2,000,000,001 – 4,000,000,000 | 0.75% |

| First-time Premium | > 4,000,000,000 | 0.50% |

| Renewal Premium | ≤ 5,000,000,000 | 0.50% |

| Renewal Premium | 5,000,000,001 – 10,000,000,000 | 0.40% |

| Renewal Premium | 10,000,000,001 – 15,000,000,000 | 0.30% |

| Renewal Premium | 15,000,000,001 – 20,000,000,000 | 0.25% |

| Renewal Premium | > 20,000,000,000 | 0.20% |

Prior to this 2022 notification, companies such as MetLife operated under regulations dating back to 1958. Analysts have described the new rules as a significant step toward modernising and increasing transparency in the management of foreign head office expenditures.

IDRA emphasises that these measures aim to control international operational costs, streamline registration processes, and strengthen overall governance within the life insurance sector. By doing so, the authority seeks to safeguard the interests of policyholders while promoting a sustainable and transparent business environment for the country’s life insurance industry.

Bank of America’s Chief Executive Officer, Brian Moynihan, has projected that the United States econ...

Mymensingh, 23 January — A police constable was critically injured in a violent assault at a checkpo...

Ramadan Demand Pushes Up Prices of Essentials as Vegetable Costs Climb in Dhaka MarketsWith the holy...

In a chilling incident from Andhra Pradesh, India, a woman is alleged to have murdered her husband b...

Bauphal, Patuakhali – In a shocking incident late on Thursday night, a school teacher and her teenag...

Bangladesh has openly rejected the deadline set by cricket’s global governing body, the Internationa...

In the early hours of Thursday morning, a fire broke out at a tin-roofed market in Siddhirganj, Nara...

At the very start of February, government employees in Bangladesh can enjoy a continuous four-day br...

Gopalganj-3’s ‘rebel’ BNP candidate, Habibur Rahman, has officially launched his campaign for the up...

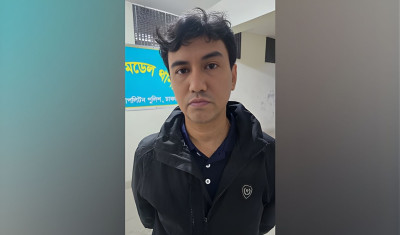

Dhaka police have arrested Pobitro Kumar Barua, the manager of Sharmin Academy, following the shocki...

In a late-night enforcement drive, a mobile court in Biral, Dinajpur, imposed fines on 52 individual...

Mohammad Yasin, the main accused in the murder case of a Rapid Action Battalion (RAB) officer, has w...