Khaborwala Online Desk

Published: 17 Jan 2026, 01:56 pm

The United States banking sector is confronting a complex political and operational challenge following President Donald Trump’s call to cap credit card interest rates at 10 per cent. Announced on 10 January, the directive is scheduled to take effect on 20 January 2026 and remain in force for one year. However, the White House has yet to clarify how the measure will be implemented or enforced, generating uncertainty across financial institutions. In the immediate aftermath of the announcement, banking shares exhibited heightened volatility, exceeding normal daily fluctuations.

Analysts have cautioned that a simple executive order or administrative guideline is unlikely to impose such a cap unilaterally. Legislative approval from Congress would be required, a process that has repeatedly stalled in the past. Regulatory experts note that, in the absence of clear directives, banks may be reluctant to take proactive measures, further complicating compliance.

White House economic adviser Kevin Hassett has suggested an alternative approach, allowing banks to voluntarily offer lower-interest “Trump Cards” to selected customers. This proposal was discussed during an appearance on the Fox Business Network. According to Bloomberg, the administration is evaluating whether an executive order could provide an immediate solution.

Industry sources indicate that major banks are actively engaging with the administration to seek clarification. “Even amid ambiguity, lenders are taking the directive seriously,” said a senior credit management official. Several institutions are already preparing senior executives for potential dialogue with the White House.

Historically, banks have opposed congressional efforts to limit credit card interest rates, arguing that such restrictions reduce lending capacity and limit consumer options. Consequently, industry representatives are preparing to intensify lobbying against the new initiative.

Proposed Rate Cap and Bank Responses

| Aspect | Details |

|---|---|

| Proposed Interest Rate | 10% per annum |

| Effective Date | 20 January 2026 |

| Duration | One year |

| Implementation | Unclear; requires Congressional approval |

| Industry Position | Historically opposed; concerned about lending capacity and profitability |

| Likely Bank Responses | Voluntary low-interest cards, limited benefits, potential credit limits |

Experts have highlighted that credit cards remain highly profitable for banks, and any interest rate cap could materially affect large institutions’ earnings. Some banks may introduce low-feature or reduced-rate cards, similar to offerings already seen at Bank of America. Moshe Orenbuch, Managing Director at TD Cowen, commented: “Existing or new cards could be offered at roughly 10 per cent interest, albeit with limited features.”

The White House emphasises that the guidance is not merely aspirational but constitutes a policy directive aimed at controlling household expenditure ahead of midterm elections. Market observers warn that, without a clearly defined implementation plan, volatility in banking stocks is likely to persist in the short term.

Global pop icon Harry Styles has officially announced that his fourth solo studio album, Kiss All th...

The death toll from the ongoing mass protests in Iran has surged to at least 3,090, according to a r...

The Insurance Development and Regulatory Authority (IDRA) has officially announced an invitation for...

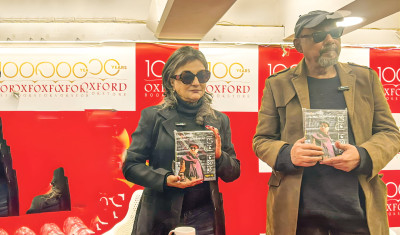

Celebrated Indian artist Anjan Dutt has unveiled his latest work, an autobiography, at the age of 72...

Paris Saint-Germain (PSG) returned to the top of Ligue 1 following an emphatic 3-0 victory over Lill...

Bangladesh’s Under-19 cricket team kicks off its ICC Under-19 Cricket World Cup campaign today with...

Recent reports from the Israeli Ministry of Defence and several prominent healthcare institutions ha...

Naveen-ul-Haq Ruled Out of T20 World CupIn a significant blow to their aspirations on the global sta...

While the global spotlight often falls upon world-record transfers and established superstars, the t...

The long-simmering tension between hip-hop heavyweights A$AP Rocky and Drake has reached a boiling p...

Bangladesh is witnessing an extraordinary surge in inward remittances, with daily inflows averaging...

In a moment of excitement for football fans across South Korea, the FIFA World Cup Trophy made its m...